Salary Calculator Plus Car Allowance

If your scheme is tax-exempt then you will also save income tax on the amount you sacrifice. A recent survey found that the average car allowance in the UK is as follows.

What Is The Average Company Car Allowance For Sales Reps

These are things that your employer pays for and you get the benefit of and therefore you pay tax on the value of these benefits even though you dont receive any extra cash.

Salary calculator plus car allowance. 8200 for senior managers. Calculating your company car tax. Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is correct in your example salary 70000 pension 514.

Weve seen monthly car allowances that range from 150 per month all the way up to 1000 per month. When I had car allowance and cash it was a good deal for me as I still got car allowance paid out at same rate throughout maternity leave - something to consider in addition to Bramshotts good. However your car allowance can also depend on other factors such as your role in the company and your salary grade.

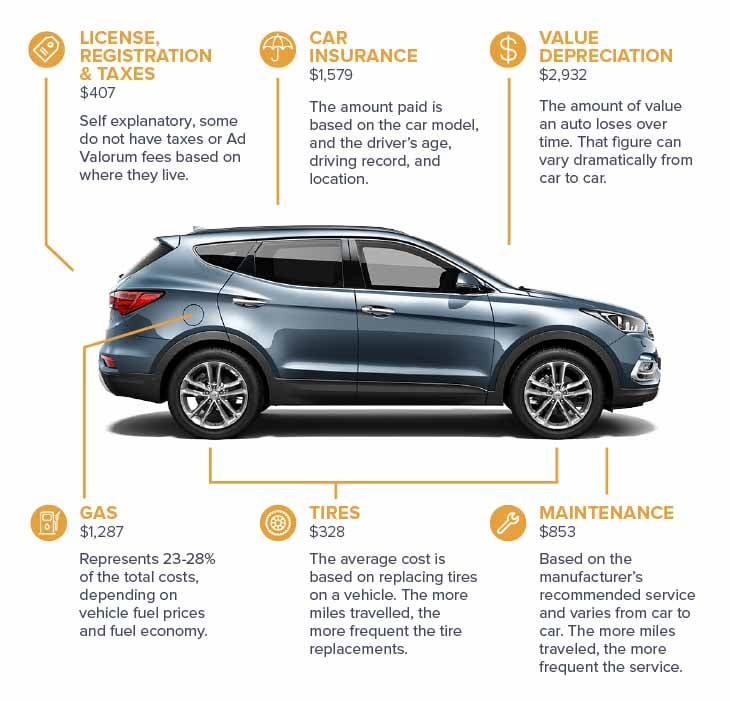

Its meant to cover the costs of using your own car. You pay for your current cars running costs using the cash youre paid as a car allowance. Add the figures from steps one through four to calculate a monthly car allowance.

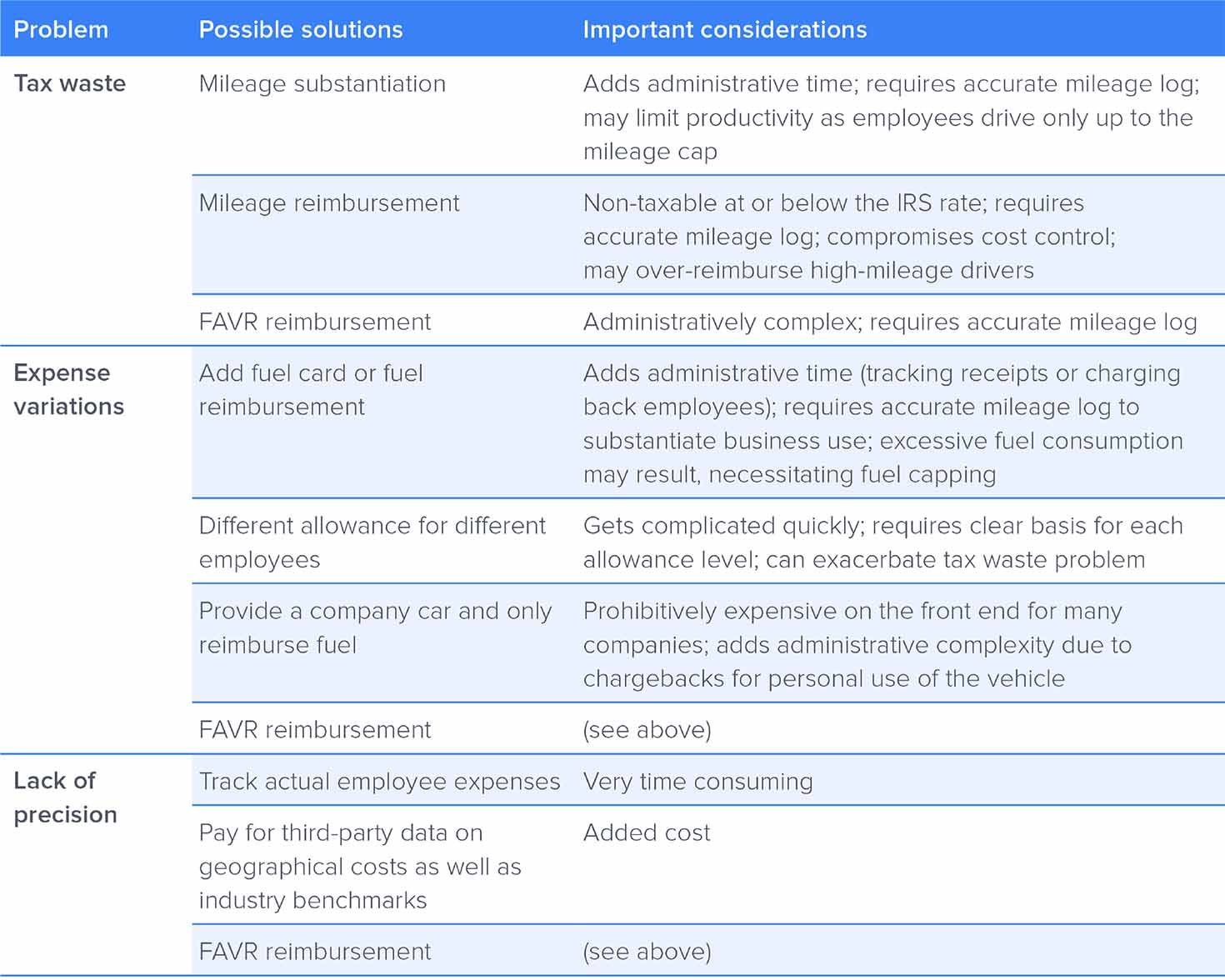

The car allowance is a hassle-free tax saving option. Every month each employees mileage is multiplied by the IRS mileage rate 056mile for 2021. A company can avoid taxation by tracking the business mileage of its employees.

28 August 2016 at 1131AM. This should state how much allowance youre providing. For example for 5 hours a month at time and a half enter 5 15.

Josh is a traveling salesperson. To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. 10300 for company heads directors c-suite individuals.

Car allowance is based on the cost plus VAT x 35 without maintenance x number of months. 5092 plus 325 for every 1 over 45000. While in both cases youre responsible for looking after the car with a company car its your employers duty to handle any payments and running costs whereas with a car allowance this would be your.

The online Tax Calculator and Car Allowance Calculator for the South African Salary and Wage earner. Company Car and Vehicle Allowances 2008. 5200 for sales representatives.

6500 for middle managers. Might be different if you take an actual car depending on CO2 etc. As a company if youd like to offer the car allowance instead of a company car you need to calculate a reasonable cash allowance per employee and add this to their monthly salary or make a bulk annual payment if you prefer.

Our organisation pays a lump sum car allowance to certain employees in relation to cars provided by the employer to the employee. Find out the benefit of that overtime. For some time now The Salary Calculator has allowed you to enter the value of any taxable benefits that you receive such as private health insurance or a company car.

51667 plus 45 for every 1 over 180000. The amount you receive can vary but is often based on what a company car would have cost your employer. A company car is a vehicle provided by your employer for you to use whereas car allowance is a cash sum that is added onto your annual salary for you to be able to buy or lease a car.

If most of. How does a car allowance work. Car allowance is paid by your employer on top of your salary which means that youll be paying income tax over it.

If you expect employees to spend an average of 1200 each year on repairs and maintenance divided this figure by 12 to get a monthly cost of 100. Employee Car Allowance Rates While there arent any average car allowance rates or data we usually come across figures ranging from 18000 to 20000 per year. The amount offered to you will be detailed in your car allowance offer as part of your benefit package and you should be able to request a break-down of the calculation for your reference.

Figure in maintenance and repair costs. There are two options in case you have two different overtime rates. You will enjoy the flexibility to spend it how you wish but the entire allowance is still treated as taxable income.

A car allowance is a set amount over a given time. The amount of company car or Benefit in Kind BiK tax you pay depends on the value of the car its CO 2 emissions your personal tax rate and whether you forgo cash for the car either under a salary sacrifice scheme or as a cash allowance. Option 2 Commercial Finance.

If you take car allowance in cash it is same as normal pay so no difference to tax. 29467 plus 37 for every 1 over 120000. Many employees who get a car allowance will qualify for a chattel mortgage finance product.

A car allowance is what an employer gives employees for the business use of their personal vehicle. Then you need to include a car allowance clause in the employees contract. To use the calculator enter your annual salary or the one you would like in the salary box above.

A car allowance covers. Enter the number of hours and the rate at which you will get paid. The employee then receives the lesser of the car allowance amount and the mileage rate multiplied by the mileage.

Read more about cash allowance and car salary sacrifice scheme rules below.

Pin By Melissa Knapp On A Little Organization Lol Budgeting Home Budget Budget Planner

Vehicle Programs The Average Car Allowance In 2021

Redundancy Pay How Much Redundancy Pay Will You Get Payment Tax Weekly Pay

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Bookkeeping Templates Business Tax Deductions

Quick Start Guide To The Dave Ramsey Baby Steps W Printable Pdf Dave Ramsey Dave Ramsey Steps Financial Freedom

Apply Online Loans Credit Cards Through Loans For Gulf Cashback Card Loan Rewards Credit Cards

.png)

Is Car Allowance Taxable Under Irs Rules I T E Policy I

2021 Everything You Need To Know About Car Allowances

Car Insurance Companies Have Been Providing A Number Of Different Insurance Policies That Benefit Its Custo Car Insurance Car Insurance Tips Best Car Insurance

Best Personal Loan Personal Loans Loan Company Business Loans

What Is Hra Calculator Online Income Tax Return Income Tax File Income Tax

Allowance Vs Cent Per Mile Reimbursement Which Is Better For Employees

2021 Everything You Need To Know About Car Allowances

Automate Your Money Build A System That Saves While You Sleep Personal Finance Money Management Finance

2021 Everything You Need To Know About Car Allowances

6 Mileage Form Templates Word Excel Templates Mileage Tracker Printable Mileage Log Printable Mileage

How To Check Online House Building Motor Cycle Car Advance Status Pay Slip Vendor Number Pifra Youtube Cycle Car Online Budget Building A House

Post a Comment for "Salary Calculator Plus Car Allowance"