Paycheck Calculator Plus Bonus

Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator.

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Use it to estimate net vs.

Paycheck calculator plus bonus. If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. Select a state to add state and local taxes. This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations.

Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to federal income taxes if. Its the tool our Infoline advisers use to. Important Note on the Hourly Paycheck Calculator.

Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll. The calculation is based on the 2021 tax brackets and the new W-4 which in. The Texas bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in. Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes.

Gross pay for W2 or salaried employees after federal and state taxes. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Determine taxable income by deducting any pre-tax contributions to benefits.

Free salary hourly and more. If your state doesnt have a special supplemental rate see our aggregate bonus calculator. Learn about workplace entitlements and obligations for COVID-19 vaccinations quarantine and self-isolation sudden lockdowns pay leave and stand downs and more.

Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 882 depending on taxpayers income level and filing status. If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator. Its so easy to use.

Similar to the hourly calculator but will allow a tax amount to be added to the gross pay to compute taxes on tips plus regular wages. Calculate how tax changes will affect your pocket. Federal Salary Paycheck Calculator.

145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. The Pay Calculator calculates base pay rates allowances and penalty rates including overtime. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Salary paycheck calculator guide. Our online salary tax calculator is in line with changes announced in the 20212022 Budget Speech. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

How to calculate net income. It can also be used to help fill steps 3 and 4 of a W-4 form. Bonus Tax Percent Calculator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Bonus Tax Aggregate Calculator. Heres a breakdown of.

If an employee has requested a voluntary deduction for tax withholding no problemyou can include that info too. Uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. In 2013 the North Carolina Tax Simplification and Reduction Act.

Multiply the hourly wage by the number of hours worked per week. Calculate withholding on special wage payments such as bonuses. Salary Income Paycheck Calculator If your employee earns a set salary the salary paycheck calculator is the perfect option.

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. North Carolina has not always had a flat income tax rate though. Go To Tax-Tip Calculator.

This is state-by state compliant for those states who. Or Select a state. Overview of Montana Taxes Montana has a progressive income tax system with seven.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use PaycheckCitys free paycheck calculators withholding calculators gross-up and bonus calculators 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs. Then multiply that number by the total number of weeks in a year 52.

This calculator is intended for use by US. For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000. There is no income limit on Medicare taxes.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The calculator on this page is.

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Account Suspended Debt Payoff Debt Free Credit Card Debt Payoff

Money Savings Ideas Budget Printables Budgeting Budgeting Finances

Article Credit To Manta Media Infradant Llc Vice President Corp Information Technology Program Project Management Prop Payroll Payroll Taxes Hiring Employees

Cost Of An Employee In Germany Calculator De Payroll

The Data Processing Cycle Discover 5 Categories Of Activities And 4 Important Steps Data Processing Data Information Processing

How Moms Can Start Paying Off Debt Pay Off Credit Card How Long To Pay Off Credit Card Payoffcr Debt Payoff Budgeting Money Financial Freedom Dave Ramsey

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

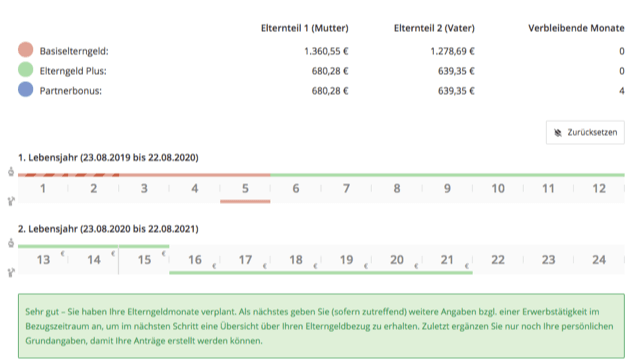

Parental Benefit Counseling Calculator Application Forms And Software

Parental Benefit Counseling Calculator Application Forms And Software

Pin On How To Get Out Of Debt Fast Group Board

When I First Got Married I Was Completely Clueless About How To Manage And Budget My Income It Lef Family Budget Worksheet Budgeting Worksheets Family Budget

Saving Challenges Budgeting Money Money Saving Challenge Money Saving Plan

Payroll Calculator Free Employee Payroll Template For Excel

52 Week Savings Challenge 7 000 Saving Money Budget 52 Week Money Saving Challenge Money Saving Strategies

Post a Comment for "Paycheck Calculator Plus Bonus"